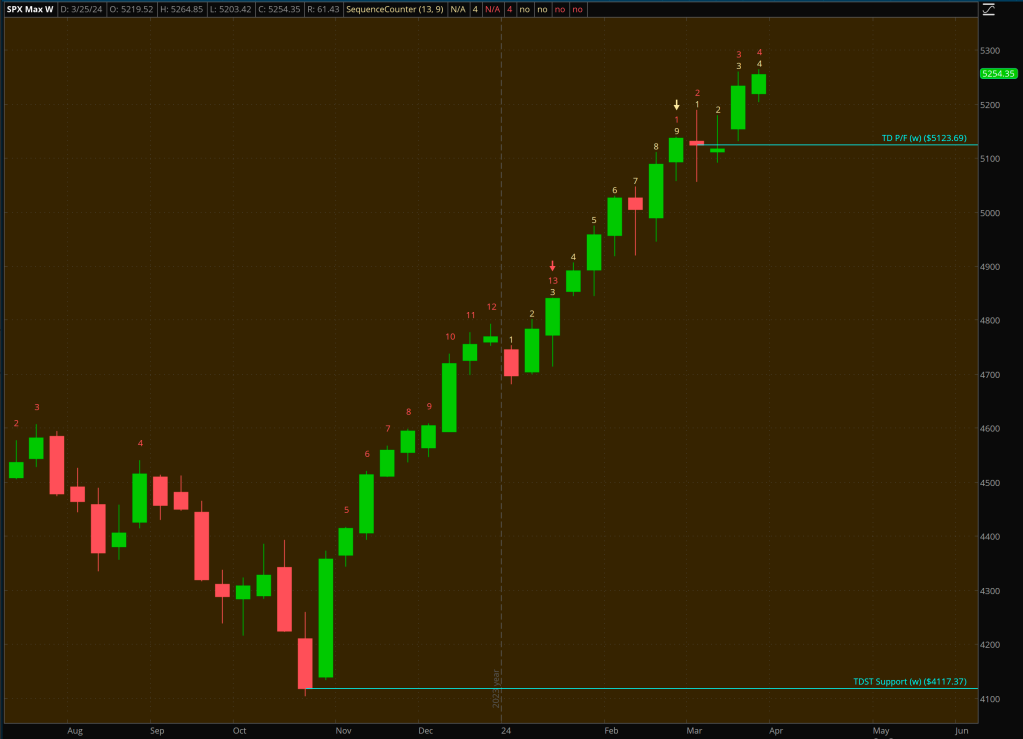

The market remains bullish and digging through individual stocks, there is continued momentum occurring in other sectors besides tech. While the new trading week is the sweet spot for a potential price exhaustion per longer term TD Sequential charts, the daily S&P 500 (SPX) has reset the DeMark counts which can carry the market to a 9 count on April 9th. The new risk parameters are set at the 60 minute TDST Support level at 5216.80. A bearish price flip on the daily SPX before recording a 9 count, and trading below 5216.80 will signal market is ready to cave.

The weekly SPX is on an incredible run. The active counts are TD Sell Setup @9 +14, and TD Sell Countdown @11. While the weekly can price flip bearish at any point, be cognizant that the weekly may dip, and be bought right back up to finish recording a TD Sell Countdown @13. It is common to see patterns where bearish patterns emerge, but the SPX goes on one more path to higher highs before a more substantial correction commences.

The monthly SPX is on a path to record a TD Sell Countdown @13 for the month of April. Unless the projected downturn doesn’t not price flip the current TD Sell Setup count, all time highs can be recorded during the November election month or December.

The quarterly SPX is on track to record a TD Sell Setup @9 halfway in 2025. Even if the SPX trades sideways through the remainder of 2024, the DeMark counts would still be active. It would take a monumental shift to deep pessimism to change course from bullish to bearish. Note the unofficial TD Risk level at 5525.59. If the market continues to melt up and records two consecutive higher closes above 5525.59, more highs are likelier than not.

Art- any thoughts here on what happens next?

SPX down 4% and it’s on the cusp of a Fibonacci convergence from various trend lows. The 10 year TNX is higher, but near the DeMark risk level. So it’s getting there. Feel like rally attempts will be sold and I’m eyeing next Tuesday with SPX around 5k before a good counter trend rally comes around. That Tuesday would satisfy a DeMark 9 and TD Trend Factor at 4972.12. That’s what’s going on in my mind.

We’re right at that Trend Factor, Art. Counter trend rally straight ahead?

Yes, but markets haven’t achieved true price exhaustion aside from the Russell. I’ll put something up in the next day.

waiting for your update.