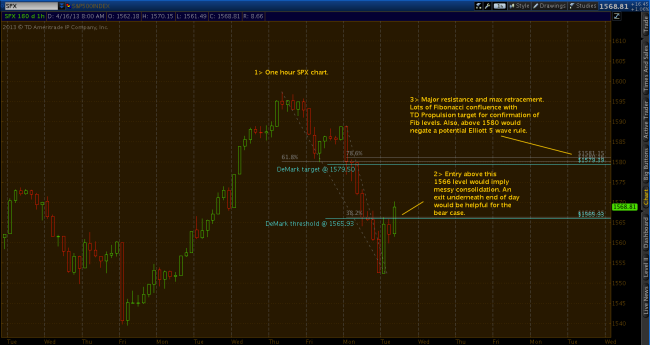

A call and response market bounce today is not a surprise. With gold cratering over 8% and the VIX 40% increase, these events create a mini capitulation and equity prices should move higher. Going forward, markets are expected to move lower. A move below S&P 500 (SPX) 1540 would make believers of some bears and then we can start to seek out a larger capitulation event. As always, I will have a plan if yesterday’s move down was just an Elliott wave 2 lower and now the markets are about ready to mount a skull-cracking wave 3 higher. There is a confluence of Fibonacci levels at the SPX 1580 level. A DeMark TD propulsion target at SPX 1579.50 also sits in the Fibonacci range. Having prices rise above SPX 1580 would also negate a potential first leg down in the Elliott wave world as the current proposed wave 4 cannot go beyond wave 1 at 1580.

A call and response market bounce today is not a surprise. With gold cratering over 8% and the VIX 40% increase, these events create a mini capitulation and equity prices should move higher. Going forward, markets are expected to move lower. A move below S&P 500 (SPX) 1540 would make believers of some bears and then we can start to seek out a larger capitulation event. As always, I will have a plan if yesterday’s move down was just an Elliott wave 2 lower and now the markets are about ready to mount a skull-cracking wave 3 higher. There is a confluence of Fibonacci levels at the SPX 1580 level. A DeMark TD propulsion target at SPX 1579.50 also sits in the Fibonacci range. Having prices rise above SPX 1580 would also negate a potential first leg down in the Elliott wave world as the current proposed wave 4 cannot go beyond wave 1 at 1580.

Despite my attempts to catch every wiggle in the markets, this monthly SPX chart should keep everything in perspective. The chart says it’s about time for this market to give back. Every occurance since 2009 has marked a fairly significant selloff when the SPX is stretched beyond the best fitted 21 month moving average.

Despite my attempts to catch every wiggle in the markets, this monthly SPX chart should keep everything in perspective. The chart says it’s about time for this market to give back. Every occurance since 2009 has marked a fairly significant selloff when the SPX is stretched beyond the best fitted 21 month moving average.

It is natural to see this bounce but some concern would be noted if the market doesn’t sell off in some form by the end of the day or if the 15 minute stochastics indicator continues to stay elevated. SPX 1580 is the bear breaker level. (updated mid trading day)